Thesis

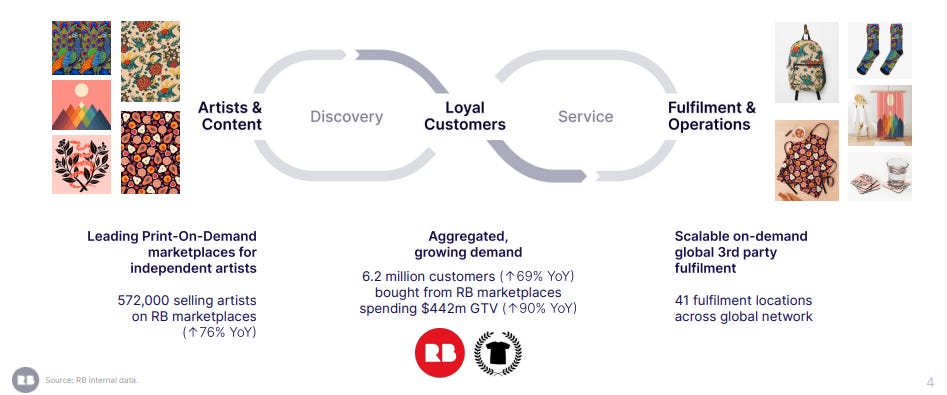

Redbubble is a two-sided marketplace that enables artists and reduces friction within the eCommerce landscape. In a traditional online marketplace, you produce the goods and then put them up for sale for customers to buy. This process forces the producer to outlay capital in order to produce a good that they hope there is a demand for. Redbubble helps solve that sunk cost problem for the creator economy within eCommerce. With third-party fulfillment and make-on-demand networks that Redbubble provides, allow sellers to scale their business without sunk costs while they figure out the demand for their niche products. Instead of creating your own store, producing the product, and attempting to drive traffic to your site, you can simply upload your designs to an already established marketplace with the infrastructure to manufacture your product and handle the logistics all in one place.

“As more artists enter the marketplace they provide more content, attracting more customers. More customers create more order volume and more order volume enables a bigger and better fulfillment network. This, in turn, brings back more customers and with more customers, more artists join and so it goes, creating a reinforcing growth cycle.” - CEO: Michael Ilczynski

This flywheel is a perpetual feedback loop with positive unit economics that has continued to show strength especially with the recent secular acceleration in eCommerce. This one-stop-shop for sellers mixed with a surge in demand adds to the stickiness of the business. I love the network effects within the flywheel. As artists aggregate to the platform because of redbubbles' value proposition for logistics and production it allows artists to focus on their designs. Better designs and products lead to more merchandise volume, and as more artists join the network the stronger the marketplace becomes. As the marketplace’s products become more attractive this drives retention within the customer base leading to repeat purchases and brand recognition.

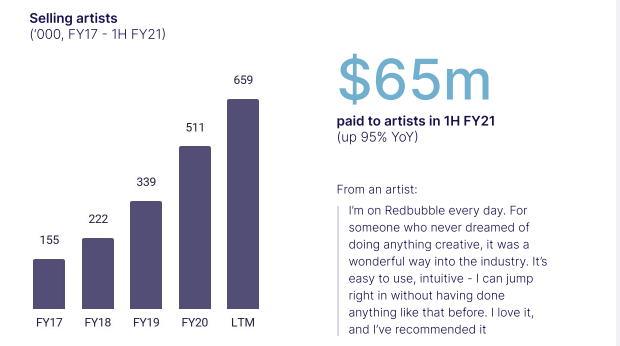

Artists

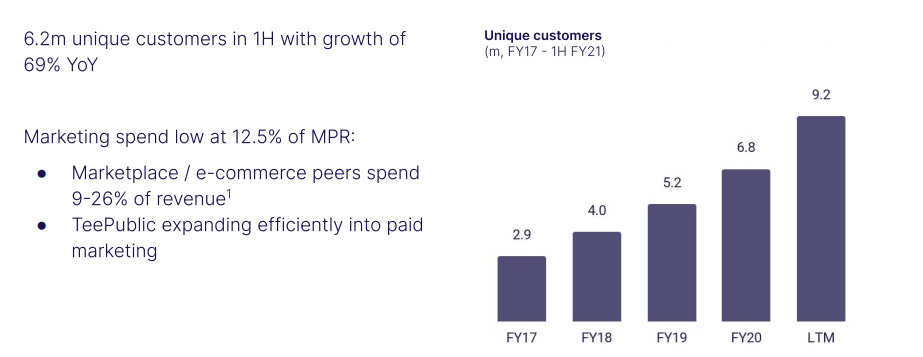

Customers

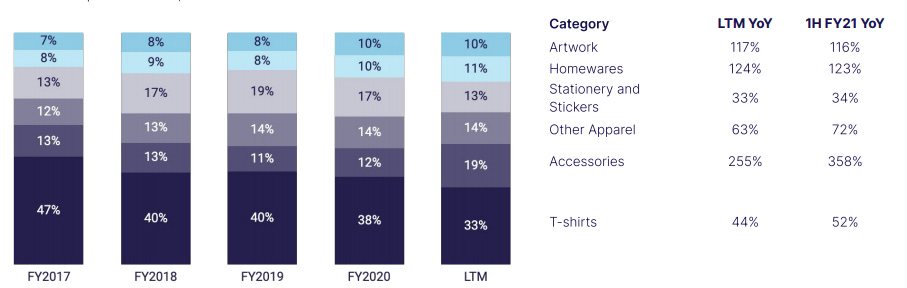

Products & Optionality

They continue to expand their product offerings as T-shirts continue to make up less and less of total revenue. Accessories have been expanding and have seen a huge boost due to mask initiatives. While these trends for products like masks are a bit unpredictable I think the optionality that Redbubble has in expanding its product offerings is compelling and favorable as the more products they can offer the easier it is for an artist to transition their manufacturing and logistics to redbubble.

Unit Economics

The offerings start with a base price and allow the artist to set their own markup margins. On a transaction like the one above a frame selling for $150 (standard markup of 20%), $25 goes to the artist and $125 goes to redbubble.

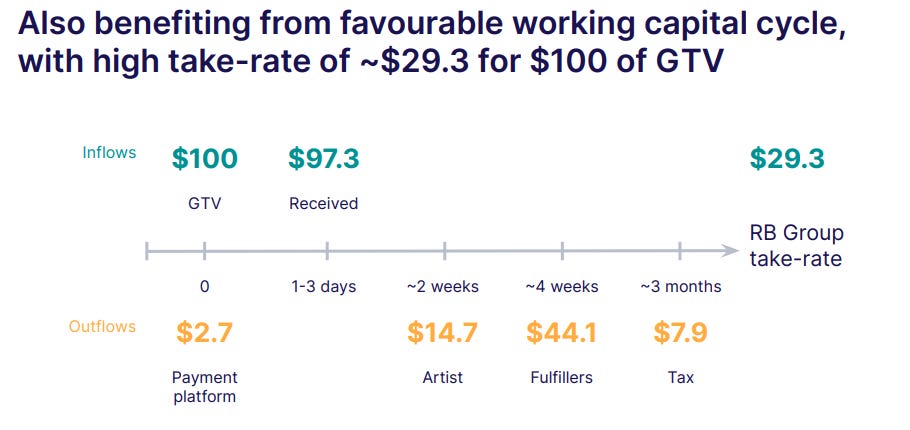

Redbubble’s take rate on a $100 transaction is around 30% after subtracting the cost of fulfillment, taxes, payment processing, and artists margin.

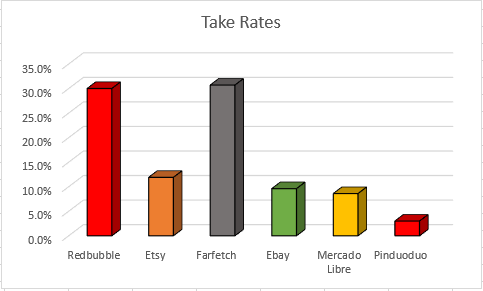

(Source: Atom.finance FY19 Take Rates)

Comparing Redbubble compared to some of the other leaders in eCommerce you can see the only other company that comes close to this type of take rate is Farfetch.

Competition and Valuation

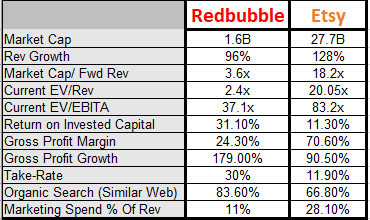

I think Redbubbles closest competitor is Etsy. Both platforms encourage artists to create and sell their products on a digital marketplace. Their uniqueness and differentiation from traditional brands are what drive the demand within the marketplace. When people want products personalized to their taste they turn to Etsy. While Etsy has a much wider variety of product offerings I think the comparison is fair given the two companies’ goals of providing a two-sided marketplace where creators and consumers can come together to find products for their personalized preferences. As I covered before, I think Redbubble has the upper hand when it comes to designers looking to find the demand for their products without outlaying capital for manufacturing and logistics.

Comparing the two, Redbubble is trading at a much more reasonable valuation while putting up some similar metrics in terms of revenue and gross profit growth. While they haven’t nearly reached the scale of Etsy I think there’s potential here if Redbubble could capturing some of their market share. At a 1.6 billion dollar market cap, there’s plenty of room for growth if Redbubble can execute as Etsy has.

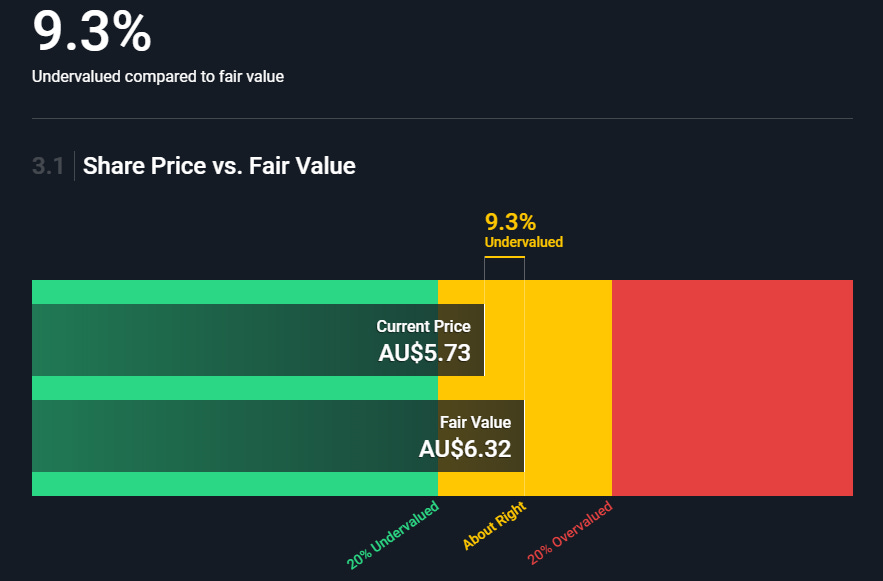

Price is still trading 9.3% below fair value based on future expected future cash flows.

Management

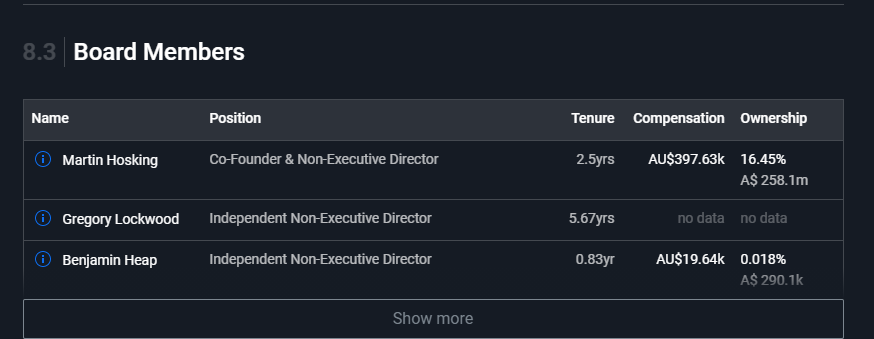

Redbubble has just recently handed over the role of CEO to Michael Ilczynski. Michael spent 13 years at SEEK, leading teams across strategy, product & technology, and commercial operations culminating as CEO Asia Pacific & Americas. The company used to be founded by Martin Hosking, but he recently stepped down but still serves on board as a Non-executive director. I love companies that are founder-led and I like to see those leaders have skin in the game. Although this recent transition could be a bit of a red flag due to uncertainty around continued leadership of the business I still think with Hosking on the board he’ll continue to positively impact the business. Hosking also still owns over 16% of the company's outstanding shares, so I believe it’s still in his best interest for the company to succeed.

Risks

I think one of the most obvious risks is that the pull forward in eCommerce has helped tremendously and going forward they’ll be unable to continue their top and bottom-line growth. You can argue that they’ve directly benefited from a one-time economic shock that propelled eCommerce forward. They’ll now face tough comps going forward and if they’re unable to continue to execute their impressive growth numbers shares will likely suffer. Another risk is that masks have been a huge contribution to their sales and with the uncertainty of how long masks will be needed given vaccine distributions and hospitalizations falling (in the US). This was the argument against Etsy as well but we’ve seen from their previous quarter that they’ve been able to retain customers beyond just mask purchases. Redbubbles product offerings are still also limited. It’s still uncertain how much demand can be generated from such a limited amount of niche products. Things like accessories and stickers are low margin, non-essential items for the everyday consumer. You can argue that e-commerce is mostly a winner-take-most market and Shopify and Etsy are the clear winners so why not own those instead.

Overall

Overall, I think the story behind Redbubble is compelling. I think it helps reduce a lot of the friction and startup costs for sellers entering the eCommerce marketplace. The flywheel effects are intriguing and seem to be generating more and more network effects as sellers continue to gravitate towards the platform. I think the current valuation and market cap imply that there is plenty of opportunity for growth and when you compare it to something like Etsy, it looks like a bargain. I also like the name because it’s a bit contrarian and there's not a lot of buzz around the name despite great growth numbers. The barrier to entry to even purchases of shares (trades on the ASX exchange has ADR but very low volume) makes it even more intriguing for a contrarian take on eCommerce. While you can argue that this spike in eCommerce will be short-lived I still think we’re in the early stages with plenty of runway ahead of us. The optionality within Redbubble to expand its product offerings and continue to scale its unique value proposition for sellers makes the future growth look promising. With the founder Hosking still on the board and with significant skin in the game also improves my confidence as incentives with shareholders are aligned. While shares have appreciated greatly in 2020, they’ve recently been pulling back (about 25% off the highs) and I’ll be looking to start a position in the $4-$6 range.

Here’s the video of me pitching it live on “The Market” game with some of the great community members over at Commonstock.

The ideas I share are my own and should not be considered investment advice. Do your own due diligence. You can't borrow conviction